What is an Expense Report?

- Free customizable iWork budget templates for Mac Numbers and Pages including weekly, bi-weekly, monthly and yearly personal budget templates and planners, paycheck budgets, and more. You will find 15 Budget Templates Templates for Mac Pages / Numbers. Budget Templates Mac Numbers. Simple worksheet of monthly expenses and income, with.

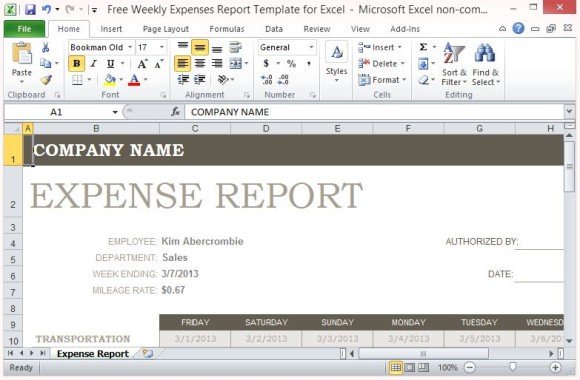

- Expense Report Template Free Excel. Expense Report Template Free Excel. Admin March 26, 2021 Templates No Comments. Free Excel Expense Report Template For Mac.

- 23 Expense Report Form Templates; Sample Business Expense Report Form - 8+ Free Documents in PDF; People make use of standard report forms to help them provide information regarding the details of certain events. A good example would when one were to make use of an accident report form regarding how an accident took place, as well as other.

According to the Expense Report definition, an expense report is a record that tracks all the expenses that employees acquire while performing activities vital for their jobs.

File page: 1 Page (s) File size: 32KB. Travel Expense Report Template is usually used by an employee to apply for reimbursement after travel. The Travel Expense Report should include the employee information and travel information. The expenses consist of Transportation, Own car, Lodging, Meals, Conference fees, and so on. 6 Expense report templates Word Excel. You can simply log your all business or personal expenses in a handy way using this expense report template because it is a best option to make expense report in a while. Expense report is a document allowing you to track workforce and production related costs in an organized manner.

The purpose of this record is to serve as a basis for a cash reimbursement request for the amounts the employee spends while on a particular business duty.

Here's how expense reporting works in more detail:

- Each time employees on business duty pay in cash, they use an Expense Report to itemize their expenditures.

- They attach the expense-related receipts to the Expense Report, to serve as proof that the amounts listed in the Report match the actual amounts spent.

- They submit the completed Report to their employer or company bookkeeper, who writes them a check to reimburse the listed expenses.

What is an Expense Report used for?

Different types of Expense Reports call for different types of data entered.

Notable examples for items employees may need to add in their Expense Reports include:

- Money spent on gas during business travels or for running everyday business errands

- Money spent on means of transportation during business travels

- Money spent on business lunches and dinners with clients

- Money spent on lodgings during business travels

Now, no matter the exact data the Report asks you to fill in, the purpose of your Expense Report is always the same — providing detail and proof for the job-related expenses that require reimbursement from the employer and company.

What your Expense Report says about you?

According to the Wall Street Journal, Expense Reports can say a lot about the employees who fill them out — and underline some of the problems these employees have with their Expense Reports.

Research helps distinguish among 5 different types of employees when it comes to the way they approach the process of expense reporting.

So what type are you?

Are you an Expense Report 'Sidestepper'?

The Sidestepper is often reluctant to report his or her expenses to the employer, no matter how big or small.

Let's call the Sidestepper 'Alice'.

Alice finds the data she needs to add to her Expense Report confusing.

She believes the process takes too much of her time.

She also fears that her employer will start questioning the items in her Report if some of the items turn out pricer than expected.

So, Alice the Sidestepper often decides that it's easier not to report the expenses and often pays for them from her own pocket.

What to do if you're an Expense Report 'Sidestepper'?Take your time to understand the expense policy of your company — ask for further clarification from the company's bookkeeper or your colleagues when needed.

Treat your Expense Report like a work task, and define the time you'll spend on it on a daily or weekly basis — then, track the time you spend filling out each Report, to make sure you stay within your predefined time limit.

Where applicable, use the note and description sections of the Reports to clarify why certain items turned out costlier than one would expect.

Are you an Expense Report 'Martyr'?

The Martyr often avoids filing for expense reimbursement. But, unlike the Sidestepper, who avoids the process because it's too 'confusing', or 'stress-inducing', the Martyr does so because he or she feels personally 'close' to the company and its cause. Hence, Martyrs treat these business expenses like their own.

Let's call the Martyr 'Peter'.

Peter the Martyr rarely asks for reimbursements, and he covers most of his job-related expenses from his own pocket.

What to do if you're an Expense Report 'Martyr'?Free Expense Report Template For Mac Computer

The feeling of closeness you have to your company is admirable, but you should still file reimbursement requests for your business-related expenses — at least to stay compliant with the expense policy of your company, if nothing else.

Are you an Expense Report 'Payback Artist'?

Unlike the Sidestepper and the Martyr, the Payback Artist is overzealous in asking for expense reimbursement.

Let's call the Payback Artist 'Matt'.

Matt asks for reimbursement for every dollar he spends — because he wants to pay the company back for something he believes is an injustice toward him.

This 'payback' may be tied to his salary being smaller than the one he thinks he deserves.

Or, it may be tied to Matt thinking his superiors have salaries much bigger than he thinks they deserve.

It may also be tied to some rejected expense reimbursement he experienced in the past — and now he wants to settle that expense indirectly, through other requests.

So, Matt the Payback Artist decides to file for as many expense reimbursements he believes are enough before he and the company are square.

What to do if you're an Expense Report 'Payback Artist'?If you unjustly didn't get approval for a past reimbursement request, don't turn to payback — sure, it might make you feel better, but it does nothing to stop the problem from happening in the future. Instead, turn the matter over to a higher entity in your company.

If you think your salary is unfair, don't up your Expense Report to make matters even — try asking for a salary raise, coupled with concrete proof of why you deserve one. You might be pleasantly surprised by the outcome of it.

Are you an Expense Report 'Rookie'?

Now, the Rookie is also overzealous in making sure the expenses listed are in order — because he or she generally doesn't know for what and how to ask for a reimbursement.

Let's call the Rockie 'Christina'.

Christina just got her first job at a prestigious company, and she's still unfamiliar with how the expense policy of her new company works.

It's hard for her to make decisions on what to file a reimbursement claim for. When she travels for business, she books cheap flights and stays in economical hotels, because she believes that's the right thing to do.

Let's now look at another Rockie — 'David'.

David also just got a job at a prestigious company. However, unlike Christina, David always asks for the most expensive services when on a business trip, because he believes that's what the concept of expense reimbursement is for.

So, Christina and David are both Rookies, but in different ways — she is afraid of overstepping an imaginary boundary, and he treats the reimbursement policy like an invitation to spend money freely.

What to do if you're an Expense Report 'Rookie'?Study the expense policy of your company, and underline the points you don't understand. You can then ask the company's bookkeeper to clarify these points — or, you can ask your colleagues about the general amounts they spend on the items you tend to overspend or underspend on.

Are you an Expense Report 'Gifter'?

The Gifter generally plays loose with the 'business' part of the phrase 'business expense policy' — and tends to also ask for reimbursement for more personal expenses.

Let's call the Gifter 'Anabelle'.

Anabelle likes to expand the expense policy beyond typical business expenses — to items that range from babysitting services to new jewelry.

But, she is a high-achiever at her company, so the employer generally turns a blind eye to such behavior.

So, Anabelle the Gifter is similar to the Rookies David and Christina — the difference is that she knows her expense policy well, yet she often decides to bypass it.

Free Templates For Mac

What to do if you're an Expense Report 'Gifter'?You might want to be more careful about adding questionable items to your Expense Reports — just because you got away with it 3 times, it doesn't mean you won't get into trouble the 4. time. So, try to keep your expense reimbursement requests within a reasonable amount and purpose.

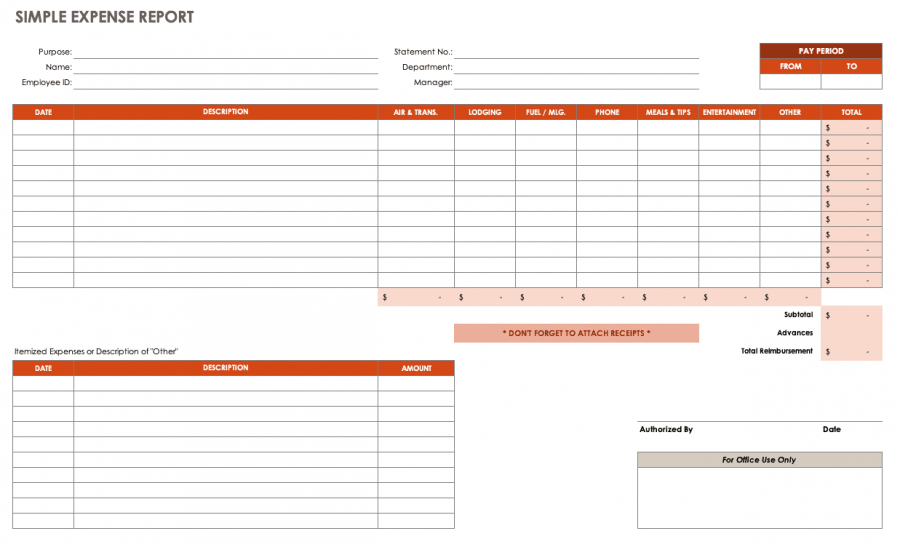

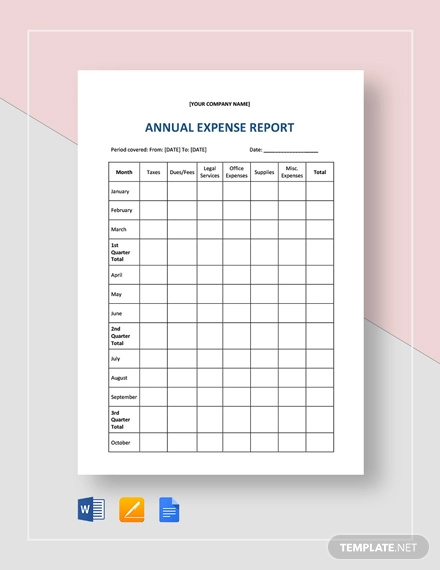

We tried to get some amazing references about Expense Report Templates for Mac and Simple Expense Report Spreadsheet for you. Here it is. It was coming from reputable online resource and that we like it.

We hope you can find what you need here. We constantly attempt to reveal a picture with high resolution or with perfect images. Expense Report Templates for Mac and Simple Expense Report Spreadsheet can be beneficial inspiration for those who seek an image according specific categories, you will find it in this website. Finally all pictures we've been displayed in this website will inspire you all. Thank you.

Download by size:HandphoneTabletDesktop (Original Size)

Back To Expense Report Spreadsheet